Failure to do your tax planning before the end of the year can cost you money.

There are methods you can follow to make sure that, come the end of the year, you keep your tax liability low and you maximize your potential outcome by preparing your write-offs and charity donations in advance.

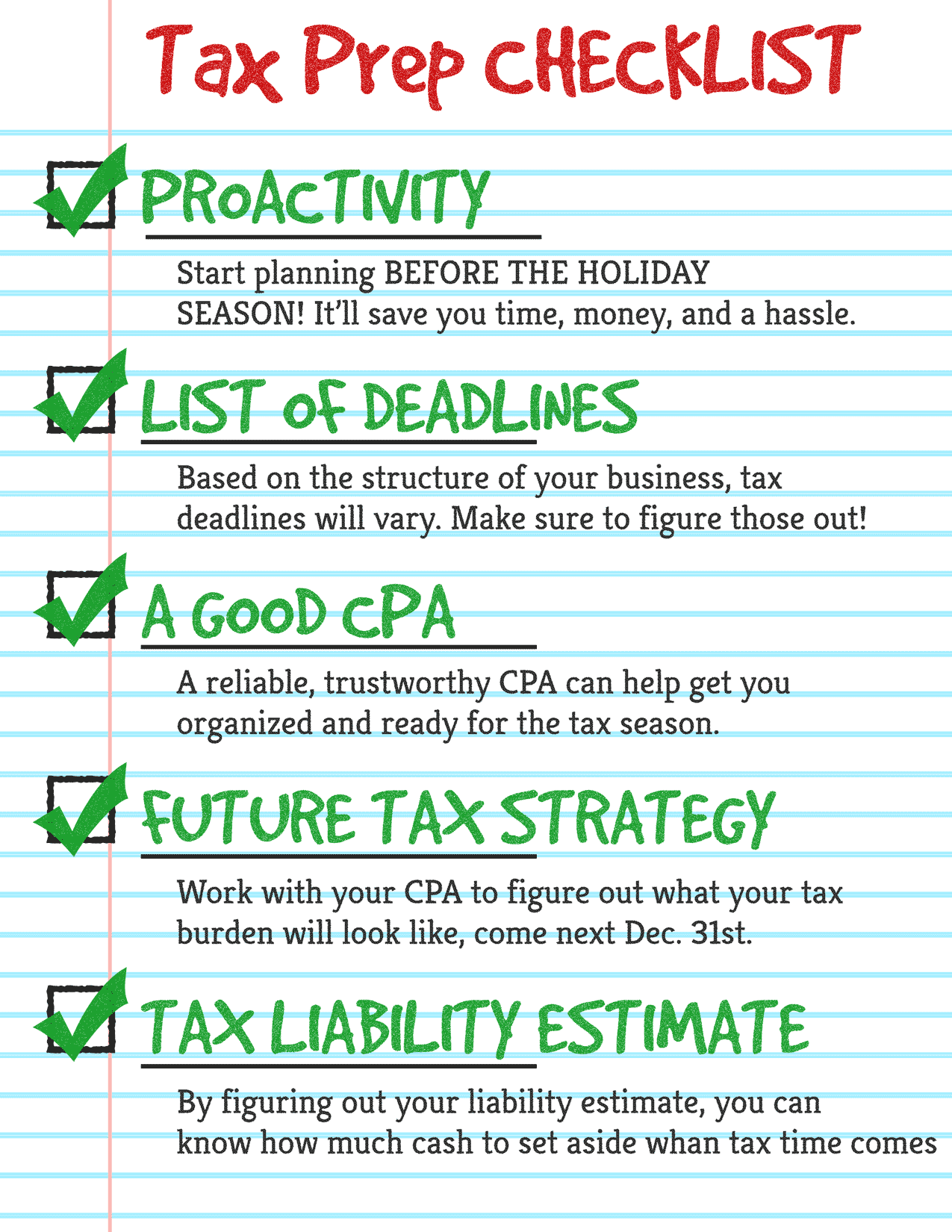

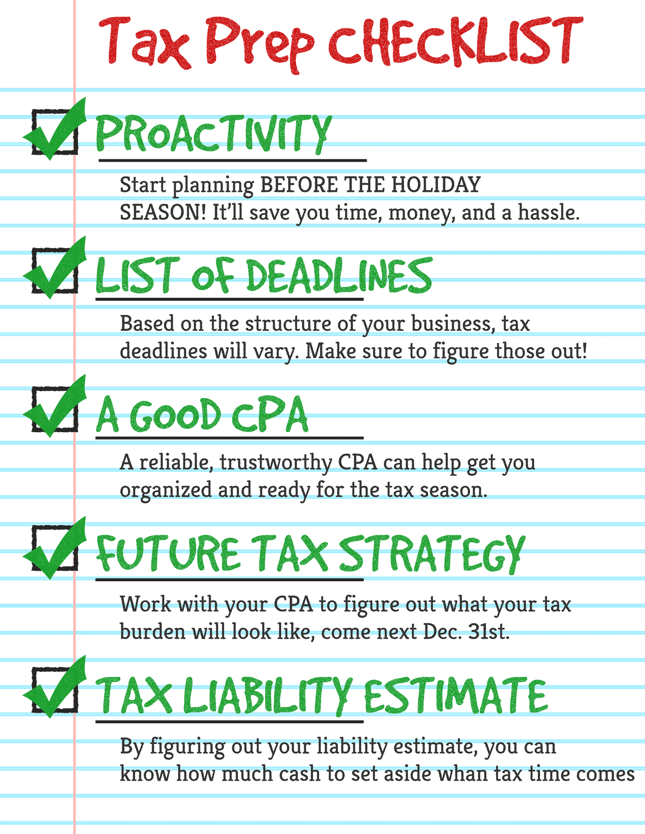

We've assembled a quick checklist for this and next year's tax preparations.

Proactivity

Just like planned maintenance on any machine, being proactive with tax planning will end up saving you more in the long-run.

Putting together a plan—rather than just playing the cards you're dealt at the end of the year—will give you an idea of your tax liability, which in turn gives you more time to organize your cash for payment.

Paying taxes on time will end up saving your small business a lot of money. Most people think that filing for an extension, as long as it's by the deadline, comes with no expense.

However, the IRS charges a penalty of 5% of the tax you owe compounded monthly for every month you don't pay.

List of Deadlines

Your company's structure has a lot of influence with regard to how you're being taxed (i.e., partnership, sole proprietor, LLC, S-corp, etc.) and which date is your filing deadline.

This site actually has a list of the tax deadlines.

Failure to pay on time is going to increase your bill. You can't pay on time if you're not sure about your deadline. The penalty is too extravangant to let yourself forget.

A Good CPA

CPAs who are experienced and work hard for you are difficult to find. A CPA who understands your business and how it works is also important.

Find someone you can trust, someone who's reliable.

Have the CPA review your current bookkeeping for the year and provide you with feedback and recommendations so you don't end up paying them ridiculous amounts of money at the year's end to clean up the books or reconcile.

'm sure you'd rather pay your taxes.

Future Tax Strategy

Once the current year is taken care of, it's time to plan for the years to come and build a new plan with your CPA.

This may include planned capital purchases, bonus structures, inventory & supply purchases, and how general year-end spending will affect your tax burden come the end of the year.

Tax Liability Estimate

After deciding these things, the CPA should be able to give you a good idea of what your tax liability for the year and help plan to set aside the funds necessary to pay for them.

Don't file for the extension, it's not worth it.

For additional information, here's a link directly to the IRS' page about tax extensions and their penalties.

Last, just remember that paying taxes is a good thing. If you're paying taxes, it means that you're making money.

Without taxes, most of the necessary laws and services wouldn't be in place that allow your business to succeed.

Paying them up front opens more of your cash after March, and doesn't keep you hog-tied until September.

It may be a struggle for the first year, but once a plan is in place with your tax professional, there's no reason why taxes shouldn't become just another simple payment,