Most people are not very good at managing their finances. People that develop poor personal financial habits typically let those habits affect the management of their business finances. As Americans we live in a world where debt is acceptable and many people adapt the habit of living beyond their means. Many bad financial habits are handed down from people’s upbringing. Other bad money habits are developed due to the influence of the society we live in. Here are a few reasons people suck at managing their finances and how to break those habits.

Most people are not very good at managing their finances. People that develop poor personal financial habits typically let those habits affect the management of their business finances. As Americans we live in a world where debt is acceptable and many people adapt the habit of living beyond their means. Many bad financial habits are handed down from people’s upbringing. Other bad money habits are developed due to the influence of the society we live in. Here are a few reasons people suck at managing their finances and how to break those habits.

Concept of Money is Weird

One of the reasons that people are bad at managing their finances is because the concept of money is kind of weird. Think about it; someone decided to print our presidents faces on some paper with different numbers and tell you the value they have. Additionally a market developed where you can exchange this paper for goods and services. It’s weird right?

Then there are checks. I write down on a piece of paper that I am turning this many numbers of value over to so and so. One bounced check teaches you the flaws of this system.

Next is credit cards. Don’t have those pieces of paper or a check right now? Don’t worry about it, swipe your plastic card in my machine and I will give you what you want. This is where a lot of people get in trouble with their finances.

If you are not convinced yet that the concept of money is weird in come new concepts like Bitcoin. To keep things as simple as possible Bitcoin is a virtual currency. Basically people “mine” new Bitcoins by calculating complex and unique mathematical equations. It’s weird yet it has real value.

What do all forms or money have in common? They all have value. If you can exchange a bill, a check, a credit card swipe, a Bitcoin or anything else for goods and services it has value. It’s a weird concept to understand and that is why people struggle with it.

Don’t Know Where Finances Are At

A lot of people and businesses just don’t know where they are at with their books. In the business world we refer to this as bad bookkeeping. Regardless if you are dealing with your personal bookkeeping or small business bookkeeping it is important to keep updated and accurate financial records.

Many business owners find bookkeeping intimidating since it is not there area of expertise. The worst thing you can do is avoid your bookkeeping. Find a professional bookkeeping service to do it for you or help you get it done with some oversight. Many business owners neglect their bookkeeping and end up creating a mess. When the time comes to file taxes many business owners are stressed out because their books are inaccurate and out of date. Growing a small business without a proper bookkeeping system in place is like operating blind.

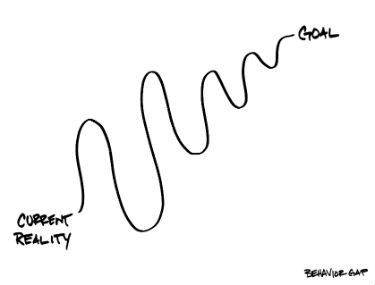

Don’t Know Where You Are Going

If you don’t have an updated bookkeeping system (where you are currently at) you certainly don’t know where you are going (forecasting and budgeting). It is extremely important to develop a small business budget every single year. This way you have goals for both income and expenses. You should enter your budget in QuickBooks to make comparing your actual financial results to your budget simple.

It is equally important, if not more important, to maintain a financial forecast for your business as well. What is the difference between a budget and a forecast? A budget remains stagnant while a forecast changes depending upon actual results and expectations. In the beginning of the year your budget and forecast should be identical. As time progresses your forecast should change based on the actual financial results of your business as well as future events you are aware of that will have an effect on your future financials. Take your actual financial performance and re-forecast the rest of your year every single month.

Don’t Know Where You Want To Go

So if you don’t know where you are, nor where you are going, you definitely don’t know where you want to go. I am a bookkeeping freak when it comes to both my small business and personal bookkeeping. I know where I am, where I am currently heading and where I want to go; from both a personal and business standpoint.

Some people just need a good small business mentor to get things done right. If you want to start this year off right let’s talk.