Many small business owners make the same mistakes when they are growing. I know that I made a ton of mistakes when I was growing my own small business. However, all good entrepreneurs learn from their mistakes and use their failures as lessons to help them grow the business in the future. In working with so many different small businesses, I feel as though our team has earned an MBA in small business growth. We learn from our clients' successes and failures and we apply that knowledge to our own business in order to make good decisions. We have had our own successes and failures and we use all the knowledge we have gained in our career to move our business and our clients' businesses forward. Below are five common small business mistakes and their solutions.

Many small business owners make the same mistakes when they are growing. I know that I made a ton of mistakes when I was growing my own small business. However, all good entrepreneurs learn from their mistakes and use their failures as lessons to help them grow the business in the future. In working with so many different small businesses, I feel as though our team has earned an MBA in small business growth. We learn from our clients' successes and failures and we apply that knowledge to our own business in order to make good decisions. We have had our own successes and failures and we use all the knowledge we have gained in our career to move our business and our clients' businesses forward. Below are five common small business mistakes and their solutions.

1. Failure to communicate your vision internally

Mistake #1: Many owners fail to put their vision down on paper and get it communicated out to the team. If you can't articulate your vision on paper and get your team on board with it, how can you expect it will ever be accomplished?

Solution: Write your vision down on paper and get it out to your team in hard copy. Let your team give feedback or ask questions about your vision. Your employees may need some additional information to gain clarity on your vision. The clearer your vision is to your entire team, the higher the likelihood it will be carried out.

2. Lack of organizational chart and job descriptions

Mistake #2: Most small businesses start out as a one person operation: the owner. It seems silly to create an organizational chart when you are the only employee. It also seems wasteful to create job descriptions for the various positions since you have to do everything by yourself. I often hear small business owners tell me that an organizational chart and job descriptions are for big corporate businesses.

Solution: Build a visual organizational chart right from the beginning. The organizational chart ties directly to your vision as the business owner. Who are the various team members you will need in order to accomplish your mission? What will these people do? The job descriptions should be separate from your organizational chart. The org chart, as a more visual document, will give you clarity on where you are going. The job descriptions will aid you in finding the right people and giving them clear tasks to achieve desired outcomes.

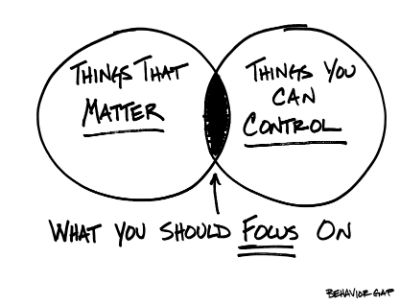

3. Executives not focused on mission critical tasks

Mistake #3: As your business and team grow, it can be difficult to only perform business tasks that actually matter. As a business owner, it's easy to get off task if you don't have clarity around what tasks are critical to your mission. As an example, email is not a mission critical task, but I bet your email is open right now and you are constantly checking it. According to a report from the McKinsey Global Institute, the average worker spends 28% of her work week dealing with her email.

Mistake #3: As your business and team grow, it can be difficult to only perform business tasks that actually matter. As a business owner, it's easy to get off task if you don't have clarity around what tasks are critical to your mission. As an example, email is not a mission critical task, but I bet your email is open right now and you are constantly checking it. According to a report from the McKinsey Global Institute, the average worker spends 28% of her work week dealing with her email.

Solution: On a piece of paper, write down all the things you do on a daily, weekly, and monthly basis. Then put the list in order of priority. Think about those tasks that you like to do and that you are good at, and then make those your priority. Delegate anything that you don't like doing or that is not critical to accomplishing your mission. Once you have your task list of the things you should be focusing on, post it somewhere visible at all times. Any time you find yourself handling something not on your task list, delegate it or eliminate it. Get stuff done!

4. Too much emphasis on the past rather than the future

Mistake #4: Business owners love to look at financial reports from last quarter or last month. In fact, they get a little too excited when their bookkeeper tells them that the books are closed. But when are your books accurately closed out each month? The 1st, 5th, or 10th if you are lucky? And what do you do with all of that analysis? Typically, when looking at past financials, business owners get too hung up on them (good or bad) and fail to use them to help predict the future.

Solution: Stop worrying so much about your past financial performance; instead, obsess about the future. In a nut shell, I am talking about creating a financial forecast. Whatever happened in the past, whether it was good or bad, is done! Move forward. Take what happened and use it to help you predict what you think will happen. Now take a look at your predictions. Are you happy with the results? If not, pivot now and make the necessary adjustments to get back on track. If you are happy with your prediction, then find a way to exploit it and make it even better.

5. Underestimating the importance of hiring

Mistake #5: Many small business owners take for granted how difficult it can be to hire the right people. Finding the right people to help you carry out your mission is critically important and also incredibly difficult.

Solution: It is important to develop a scientific hiring process that is measurable. It will be critical when you begin the process to have a detailed job description to aid you in writing the job advertisement. You also want to be sure to find a good cultural fit, as nothing is worse than working with people who don't get along. Make sure to only hire the best people and clearly communicate their job responsibilities, the desired outcomes, and the ways in which their performance will be measured. The right people in the right spots on your organizational chart will be the difference between completing your business mission and failure.

What other critical mistakes have you seen small businesses make when they are scaling up?

Photo credit #1 Canva

Photo credit #2 Behavior Gap