Taxes can be a really great thing. If you're paying taxes, it means you're making money. A CPA would tell you that until you are paying 100% tax, you should never stop trying to make more money. Paying taxes also puts money toward social services, and for some, can even be thought as a way of helping others.

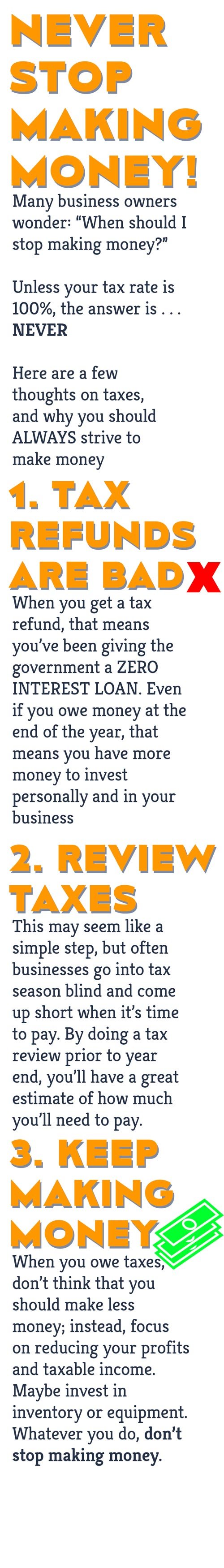

Tax Refunds are Poor Financial Decisions

When you're filling out the W-4 for employment and it asks for the amount of dependants you have, along with whether there is any extra you'd like to contribute, make sure you check none. It may be fun to receive that return at the end of the year, or think of it as an additional way to save some money. However, you're giving the government a 0% interest loan, which they can then bank in order to gain interest on it for themselves! Instead, keep the funds in your own pocket and keep the interest for yourself, or invest the money.

Come into Tax Season Prepared

April is not easy, especially if you're a small business owner. You know what this season means: having to pay last year's taxes plus the expected taxes for the current year. Some may suggest that you delay paying, if possible; but instead, we recommend that you just get them out of the way. There are so many different tax penalties along with the interest that the IRS charges for late payments, it's just not in the best interests of the company. Unless, somehow, the company thinks it can beat the interest investing in the short-term. The IRS keeps the penalties and interest amounts pretty steep, though, to minimize the risk of companies attempting to do just that.

Don't ever file for an extension again. Be prepared.

Have a plan going into this tax year and build a plan for next. Have your financials ready and be open with your CPA about what your goals are now and your projected income for next year. They may help you put together a plan to minimize your company's tax liability for the next year.

Pay your taxes on time.

Keep Making Money

As you move up through the income tax brackets, it doesn't mean you should slow down the amount of money you're making. Until a tax on a dollar is 100%, you or your company are still making money. Instead of slowing down to stay under one tax bracket, why not speed up so that by the end of the year, you're at the top of the next bracket?

For additional help with taxes or other financial planning, reach out to Salt Lake City Bookkeeping. We'd love to help you move forward in your small business and make better financial decisions.

![[Infographic] When Does It Make Sense To Stop Making Money](https://www.slcbookkeeping.com/hubfs/Never-Stop-Making-Money.jpg)