Increase Your Bottom Line With 5 Year End Bookkeeping Items

The end of the year tends to be a festive time.

A lot of time away from work, Christmas, New Year's, and seeing family. However, that doesn't stop the mind from thinking about the year end tasks that come from owning or working in a business.

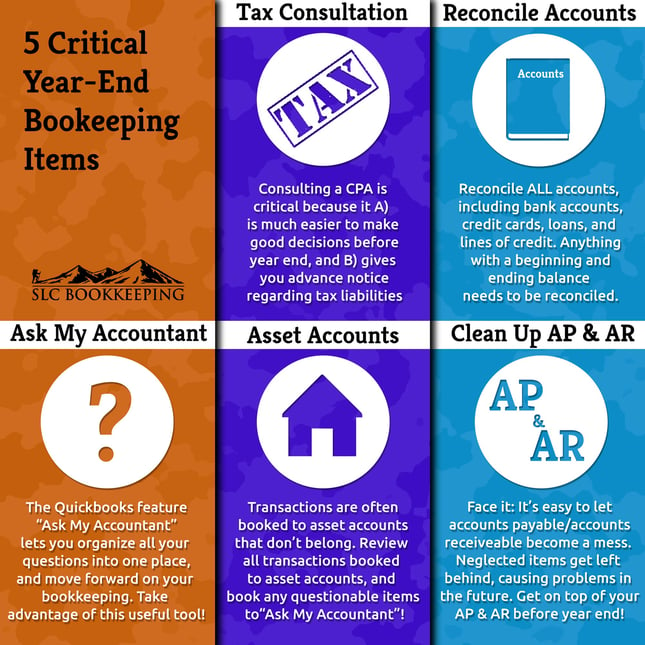

In the case of a company's books, there are five critical year end bookkeeping items that not only help a business forecast the upcoming year with accurate numbers, but also slide into the new year with relative ease.

It's no secret that tax season is coming, either.

At the end of the year there tends to be a lot of talk around tax liability, 1099s, and meetings with CPAs regarding the tax plan. These critical bookkeeping items can help make these year end tasks more simple.

Consulting the CPA can help decrease the amount of tax liability your company has and help an owner understand where they can continue to increase their bottom line in the upcoming years.

Reconciling accounts and asking an accountant about all the assets that have come into question will help the meeting with the CPA go better.

After finishing these tasks, an owner can then get an idea of how the cash flow of the business is, and what needs to be improved in the following year.

Realizing there is a lack of cash before a company dries up can actually help create a vision prior to running out and ultimately save it.

These 5 bookkeeping items can help an owner not only at year end, but throughout the entire year.

Making a habit of these 5 steps can make it seem less time consuming and make sure that they get done. When was the last time that your company completed any one of these crucial steps?

Feel free to also download one of our best eBooks we have available which may continue to help your company's year end needs:

Comments