Why All Owners Should Be a Part Budgeting And Forecasting

It is essential for a small business owner to be a part of the forecasting and budgeting process. Many small business owners don't take the time to even build a budget or forecast. Even those that do make a budget quite often don't take the time to analyze their actual performance against it, draw some conclusions, and make any necessary adjustments. Here is why every business owner needs to be a part of the budgeting and forecasting process.

It is essential for a small business owner to be a part of the forecasting and budgeting process. Many small business owners don't take the time to even build a budget or forecast. Even those that do make a budget quite often don't take the time to analyze their actual performance against it, draw some conclusions, and make any necessary adjustments. Here is why every business owner needs to be a part of the budgeting and forecasting process.

Vision

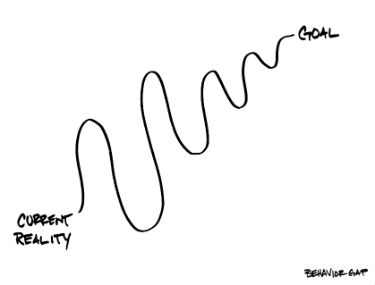

The vision of the business owner is an important part of the forecasting process. If we want to go from point A to B what does that look like from a financial perspective? Does the forecast look feasible and are we happy? What changes might we need to make along the way?

The vision of the business needs to be reflected in the forecast and the budget. While a business owner's vision can be communicated on paper to the key members of the business team their needs to be some open dialogue to truly understand where they want to take things.

Desires

All too often I have a business owner pull up their QuickBooks profit and loss statement and show it to me. Then they ask: "So are we doing well?" How the heck do I know? I don't know how you want to perform. Every business owner's definition of doing well will be different. Some may not even tie doing well with the bottom line on the P&L.

It is important that the business owner's desires are worked into the budget. Certainly you will want to consider sales goals, expense budgets and where you want the bottom line to be at. Build a budget as your best guess and leave it fixed throughout the year. A forecast is what will fluctuate and I will touch on that in the final section.

Intimate Details

The owner and management team should be very in tune with the intimate financial details of the business. Not only how the business performed in the past, but also what is expected in the future. If you plan on hiring in the next few months make sure to work that into the forecast. Build in the actual cost of the employees burdened by payroll taxes and benefits as well as any equipment that will be needed.

The management team and owner are typically aware of what the needs of the business will be in the coming months to stay in line with how they want the business to perform. They should work in any additional expenses that they will incur that they had not originally planned on. Additionally, take a look at sales trends and put a good guess on the next few months based on what you know now. Does the bottom line look good? Are you in line with your goals? Do you need to adjust?

Steering the Ship

An owner should use the budget and forecast for a business to steer the ship. Building out a forecast for the next several months after the close of every single month is critical. This allows you to spot any potential problems before they happen. Additionally you may spot opportunities that you did not notice before. You can use your financial reports to pivot at critical times. These pivots can be the difference between keeping your business on track with your vision and complete failure. Without good financial reporting as well as a budget and forecasting process you will literally be running your business blind.

Photo Credit Behavior Gap

Comments