[Infographic] Growth Through Financials

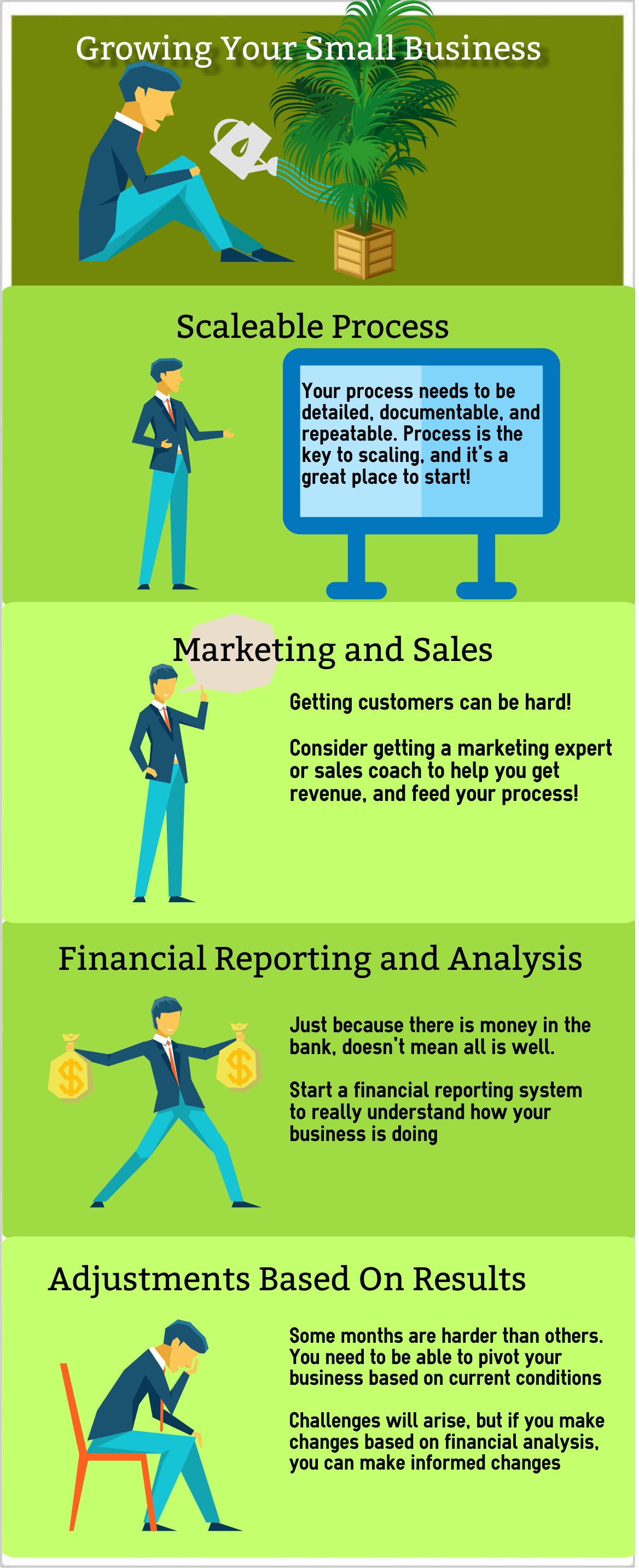

Growing a small business can be one of the biggest dreams of any owner or entrepreneur. It doesn't come easily, though, without some proper practices that help to increase the success of the business growth. For instance, company owners may want to look at making sure that the model they have is scaleable. If the model is not scaleable, the increase in clients and business could actually hurt them more than help. The growth process has to be managed in such a way that looks at how to scale the business responsibly, how to make marketing and sales dollars effective, analyzing financial reports, and making adjustments based on those results.

The actual cost can be different among all businesses, even if they are in the same industry. To get a better grip on how much it's going to take to get marketing and sales on the same page, Brad Sugars, a contributor on Entrepreneur.com, conveniently gives us the formula to calculate a customer's lifetime value. With the lifetime value, we have a better idea of how much target customers can be worth to the company, and how much money can be spent to acquire new ones. For most companies, it is about 5-6 times more expensive to acquire a new customer, when compared to growing revenue from clients who are already paying.

A tactic that is common but can be foolish is giving the marketing department a cut of last year's revenue. If a company is growing, it can be expected that the marketing budget amount should at least mirror the amount a company is planning to grow. For example, if the business would like to grow an additional 12% next year, on top of the 5% of revenue that marketing is currently receiving, the budget should be increased to match the 12%.

A marketing expert can be utilized to understand how much money should be invested in your growth, and can also help plan for where that money is going to go and what should be accomplished.

Financial reporting and analysis makes for a great way to project and benchmark a company's success. Analyzing financial performance once a week can help increase profitability. Getting a system in place will help keep financial performance out of an owner's mind and give them time to focus on the growth of the business.

Making adjustments based on a comparison of actual financial performance versus projections can help a business stay aligned with their goals and find opportunities to make processes more efficient.

There is no simple formula for growing a small business, but there are certain steps and procedures that can help owners increase business and perfect their expertise.

Comments