Help! What are Undeposited Funds In QuickBooks?

'What are undeposited funds?' is a very common question for users of QuickBooks. The short answer is, undeposited funds are funds that have been recieved by the company from the customer and not yet been deposited into your bank. To further clarify, QuickBooks follows a set of accounting activities called a flow. The following examples will better illustrate.

Analogy #1

Your company, Acme Super-Hero Cape Cleaning provides a service to your customer. Upon completion of the service you hand the customer a bill or invoice and they give you with a check or cash. Suppose this happens at your office. You then stamp the back of the check,

Your company, Acme Super-Hero Cape Cleaning provides a service to your customer. Upon completion of the service you hand the customer a bill or invoice and they give you with a check or cash. Suppose this happens at your office. You then stamp the back of the check,

For deposit only to

Acme Superhero Cape Cleaning Services

checking account 9876543

Of course you enter the payment into QuickBooks right away. However you have more capes to clean and will not be going to the bank now. In fact you will likely be receiving many payments today and can’t possibly go to the bank after each payment. So, you put the check or “funds-received-not-deposited” into your deposit bag then in your desk drawer.

At the end of the day or next day or even at the end of the week, depending on how often you like to drop off the funds at the bank, you make a run to the bank teller to drop off the deposit. In QuickBooks this is termed “Record Deposits.” Now the money is in your bank account. The funds have been received from your customer to your desk drawer and from there they went to your bank.

Analogy 2

Think of undeposited funds from the perspective of a plane trip that has a layover in the middle of it. If you fly half way around the world to a destination it is very likely you'll have a lay over before reaching your final destination. In short your funds had a layover in your desk drawer or “undeposited funds.” From there they continued on to the bank deposit. On the original flight before the layover customers paid you and arrived in the deskt drawer before boarding the next flight, consider the layover at the airport your undeposited funds. When the second leg takes off consider this heading to the bank and when you finally land the actual deposit into your bank.

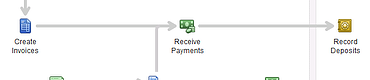

Remember QuickBooks follows a set of activities called a flow. This is why the home page of QuickBooks shows a diagram of the accounting flow. As you get familiar with this flow for payments from your superhero clients, you will realize that sometimes the steps in this flow can happen very quickly. The steps are still there.

Remember QuickBooks follows a set of activities called a flow. This is why the home page of QuickBooks shows a diagram of the accounting flow. As you get familiar with this flow for payments from your superhero clients, you will realize that sometimes the steps in this flow can happen very quickly. The steps are still there.

Suppose Thor not only got a new cape but a new credit card for making his payments. In this case when he makes payments to you with his card it goes directly to your bank because the moneys are not waiting on you to deposit them, your credit card processor will automatically batch them into your bank.

How often do you make bank deposits?

Comments