Using QuickBooks Online as a Cash Flow Tool

Cash flow is the most crucial aspect of your business's success. This isn't just your profit and loss but how money flows in and out. It can result in a negative or positive flow, with negative being where there is more money flow out than in.

Understanding your cash flow and how to use the QuickBooks Online cash flow tool provides ways to improve your profit margins, represent your business to potential investors, and know the financial health of your business. However, there isn't just one report to find this information.

Cash Flow Types

There are three ways to classify cash flow:

- Financing indicates how you finance your business and the money flow between the company and its owners, investors, or creditors. This is often the equity, debt, or payments made as dividends.

- Investing is the investment-related part of your business. A financially strong company is continuously buying and selling assets.

- Operating cash flow is the net amount a company generates. For a business to succeed and grow, this should remain positive.

A Cash Flow Statement or Financial Statement shows how the cash from the above three areas flowed through your business in a specific period.

What Role Does Profit Play in Cash Flow?

Profit is the amount left after subtracting all expenses from the incoming revenue. To obtain a correct Profit and Loss Statement, also known as an Income Statement, ensure you do the following things before running the report:

- Reconcile all bank and credit cards

- Look at open invoices or unpaid bills and clear these up.

- Calculate the taxes due and pay those.

There are three ways that you calculate profit:

- Net - the total after all expenses come out of the revenue received

- Operating - also known as earnings before interest and tax (EBIT)

How to See Your Cash Flow

In QuickBooks Online, running a financial or cash flow statement is easy. In QBO, this form is called the Balance Sheet. To obtain this report, hover over Reports on the left side menu and choose Reports from the drop-down.

Locate the Business Overview section and click on Balance Sheet.

Choose the reporting period you want to run and customize the columns desired; if you want non-zero or active-only categories, indicate if you're going to compare to another period, and then choose the accounting method.

Click the button Run Report.

The Balance Sheeet gets broken into two essential parts: Total Assets and Total Liabilities and Equity. These two parts should equal each other in a correctly balanced cash flow statement.

Looking at Cash Flow

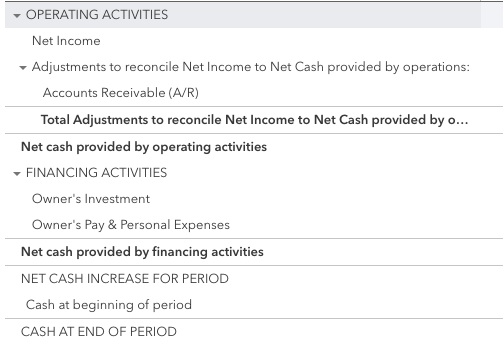

Another necessary form to see your cash flow information is the Cash Flow Statement in QBO.

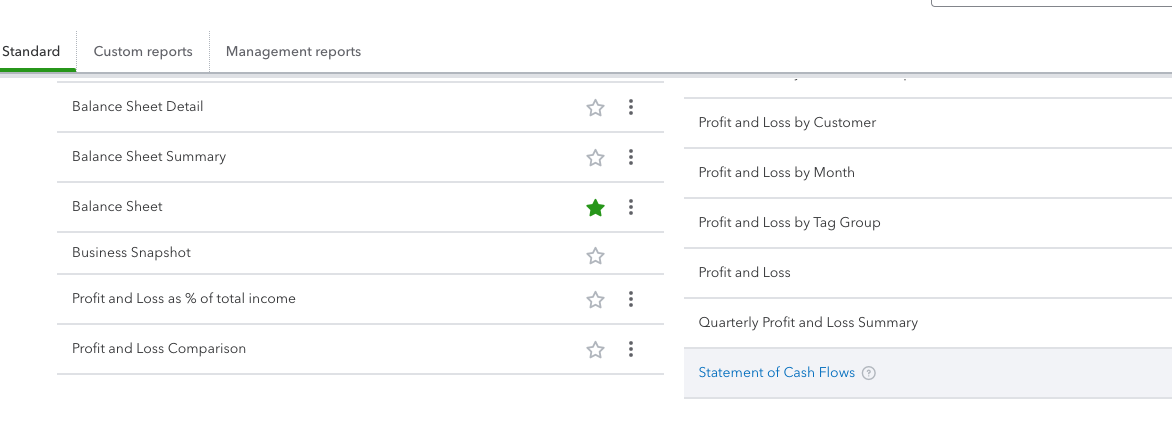

Go to Business Overview > Reports

In the Reports tab, find the "Statement of Cash Flows" report. It should be under "Business overview" unless you've done any customization to the dashboard.

This report shows the Operating, Investing, and Financing Activities.

Seeing Your Profit and Loss

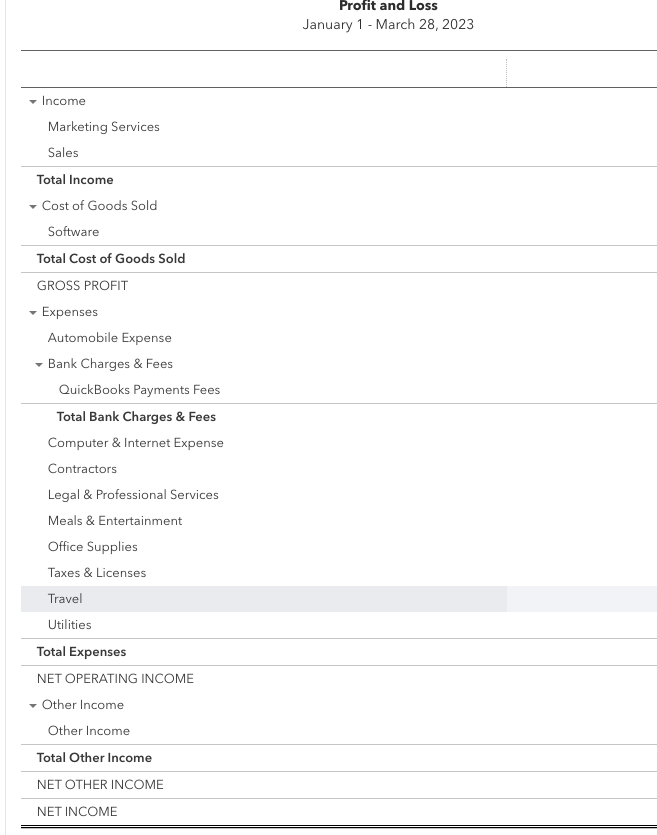

Another part of looking at your company's financial health is the profit and loss statement or P&L.

This is also located in the Business Overview section of Reports.

There are several different "profit and loss" reports created by QuickBooks, but just go for the one without any title after it.

Just fill in the relevant information and hit Run Report. This report contains the following items in this order:

Net Sales

- Cost of Sales

= Gross Profits

Selling and Operating Expenses

+ General and Administrative Expenses

= Total Operating Expenses - Gross Profits = Operating Income

Other Income

+ Gain (Loss) + Interest Expense

= Income Before Taxes - Income Tax Expense = Net Income

Here's an example of what it should look like:

You can adjust the outcome of the profit and loss report by customizing your small business's Chart of Accounts.

The Bottom Line

As you can see, there are many ways to break down the financial wellness of your company. QBO features options to paint a true picture of where you are and how you can improve your cash flow and profit.

Comments