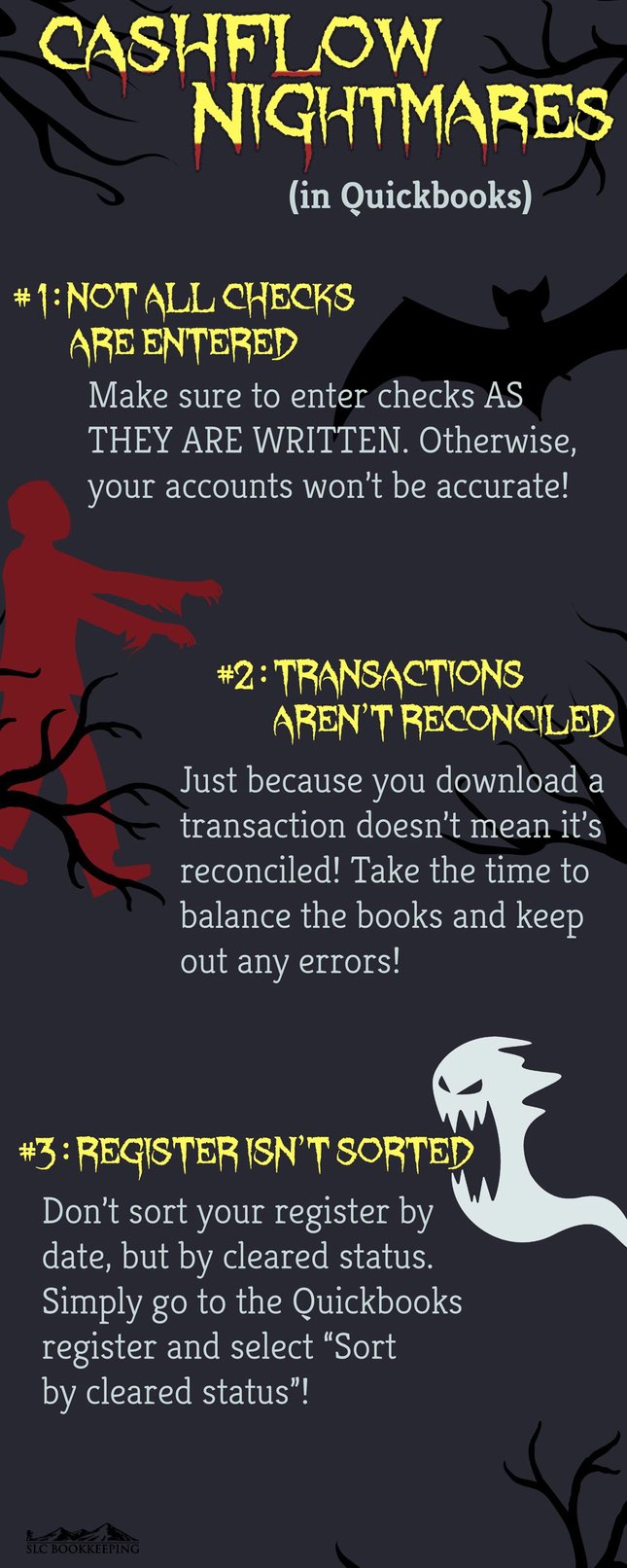

Infographic: 3 Small Business Cash Flow Nightmares

#1. Not Entering Checks as They're Written

The cost of bank fees for checks that bounce can become a nightmare. When balances in the checking account are not being reconciled at the end of the day, there is a chance that there are more outstanding checks than cash available in the account. Bounced checks and their fees are not something that an owner wants to wake up to discover. Having a bookkeeper who is regularly entering and managing the cash flow of the business can help to decrease the chances that the bank balances will be overdrawn.

#2. Not Having Reconciled Transactions

Downloading transactions and importing them into QuickBooks is not the same thing as reconciling an account. When importing the data, there may be some errors within the data, especially if it's being pulled from the bank feed. There are also times when a small business owner doesn't really reconcile or import all the accounts correctly. They may be too focused on just the bank account statements and lose focus on credit card statements, lines of credit, etc.

#3. The Register is Not Sorted By Cleared Status

Sorting the register by date doesn't necessarily show all the checks that are outstanding, thereby providing a poor representation of what is currently available as cash on hand. If the bank balance in QuickBooks is off, this is the place to start cleaning up the books. Making sure that everything matches is not very easy to do, but saving the business from these 3 different nightmares can save a lot of time and money. Have you ever written a check and then received the bounce charge a few days later? You had cash in the bank right? At least it looked like it. Then several other checks you had written went through, including the one Aunt Sally held for two months. She finally cashed it and you forgot about it. Making sure that you are sorting the QuickBooks statements by the cleared status will make sure that you never have to worry about this problem again.

Has your business been having these difficulties? Are some of these problems ones that you recognize within your books? Get a hold of Salt Lake City Bookkeeping and see what can be done.

Comments