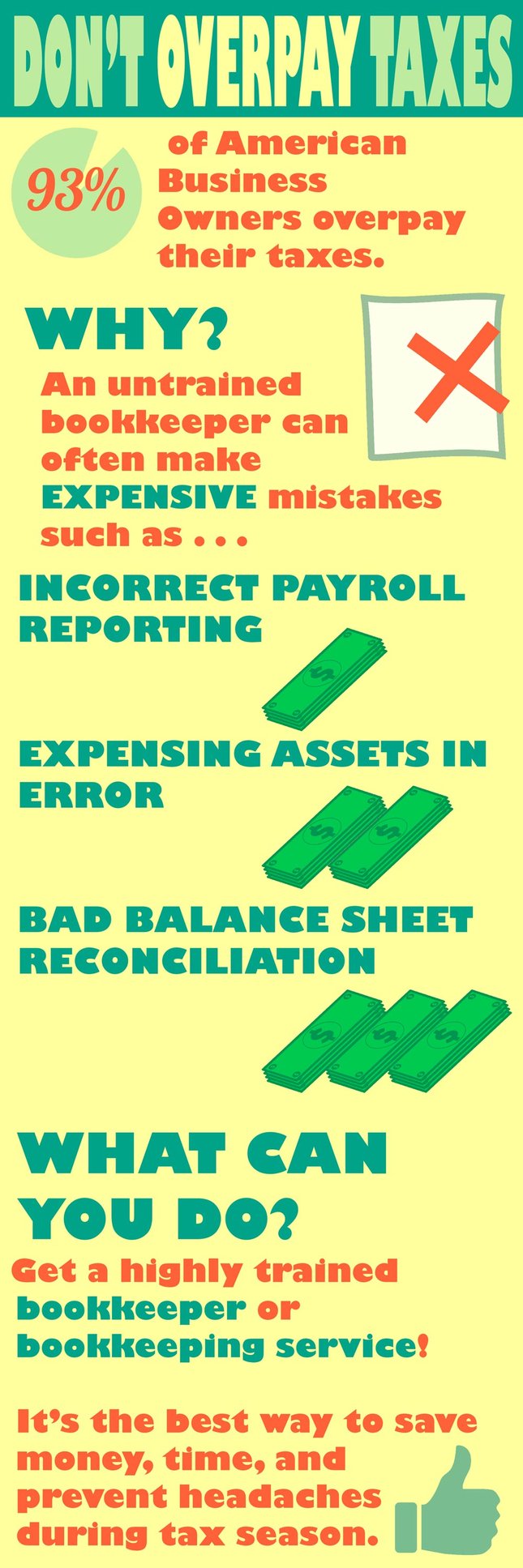

[Infographic] Small Businesses Shouldn't Overpay Taxes

Taxes are certainly something that no one enjoys paying. If a business has an accountant or bookkeeper who is filing the taxes or doing their books incorrectly, they may actually be over-filing, meaning they are paying more than the amount of tax they owe.

That isn't just in the instance of state income taxes, but also sales taxes, payroll taxes, and any other state or local tax that relies on financial information.

The potential tax overpayment can be substantial.

Sometimes, the office manager or the owner is the one doing the accounting, in addition to their full-time job. So, not only are they already stretched a little bit, piling on extra work can mean making additional mistakes.

For payroll reporting, it can be a problem if the bookkeeper doesn't understand how to enter the data properly. Gross wages need to be reported on the income statement, not net wages paid.

Balance sheet accounts should be reviewed at least once a month. At the end of the year, it's difficult to review the transactions for the entire year and make changes.

There are just too many transactions in the past year and it's time-consuming to go through all of them. Lastly, fixed assets need to be depreciated and properly reflected on the balance sheet.

Small businesses can avoid overpaying their taxes by hiring an experienced bookkeeper who both understands the industry and what the company and CPA are targeting for their tax plan.

An outsourced bookkeeper works for businesses that don't want to take on the expense of an extra employee, don't have time for training, or just have no expertise in keeping the books.

Sources: http://www.forbes.com/sites/groupthink/2015/06/09/entrepreneurs-stop-overpaying-on-taxes/#6c5e77dc549f

Comments