Why Taxes Are Just a By-product of a Solid Bookkeeping System

There is a big difference between businesses that have their bookkeeping done so they can hand off stuff to their CPA at the end of the year and businesses that actually use their books to make better financial decisions.

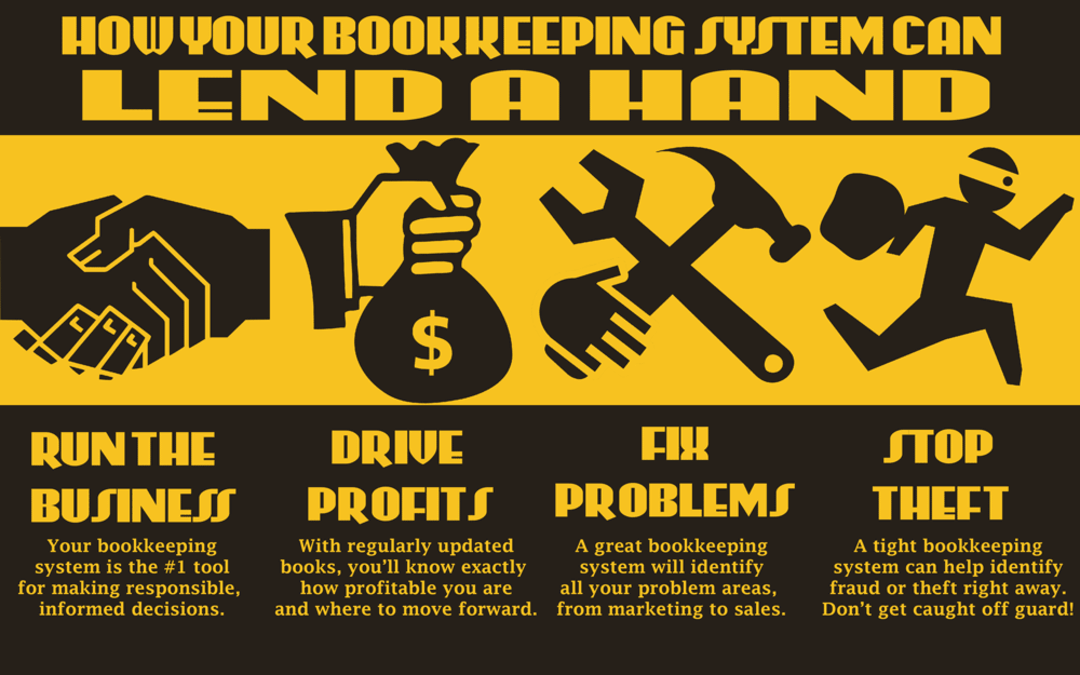

The difference is all about which of the businesses is going to win. Having a solid bookkeeping system in place can help run the business, drive profits, fix problems, and stop theft.

Help Run the Business. Critical decisions should be made using the numbers. When you are looking at numbers that are up-to-date, there is little room for a guess or gut decision that will probably get you into trouble.

Books Drive Profits. There are two ways to increase the bottom line: increase revenue or decrease expenses.

Updated financial reporting can give a small business owner the opportunity to analyze current data and report the results to key decision-makers within the organization.

Everyone can then be held accountable for hitting goals and keeping budgets on a monthly, rather than yearly, basis.

Fix Problem Areas. Recognizing how your company is increasing its revenue is important, but you can also see which types of expenses are new, which can be cut, or which have become out of control.

Stop Theft. Any discrepancies between purchases and sales can help identify theft. Tight bookkeeping standards can make sure that these discrepancies are caught early.

If you are only using your bookkeeping system to help you file taxes, then you are missing out on a valuable business tool.

Your bookkeeping system should be able to help you make business decisions, keep the business on track financially, and hold everyone accountable in your small business.

If you want your bookkeeping system to do more, feel free to reach out for a free consultation.

What information do you wish you could extract from your bookkeeping system that you are currently missing?

Comments