Bookkeeping for Multi-Location Restaurants

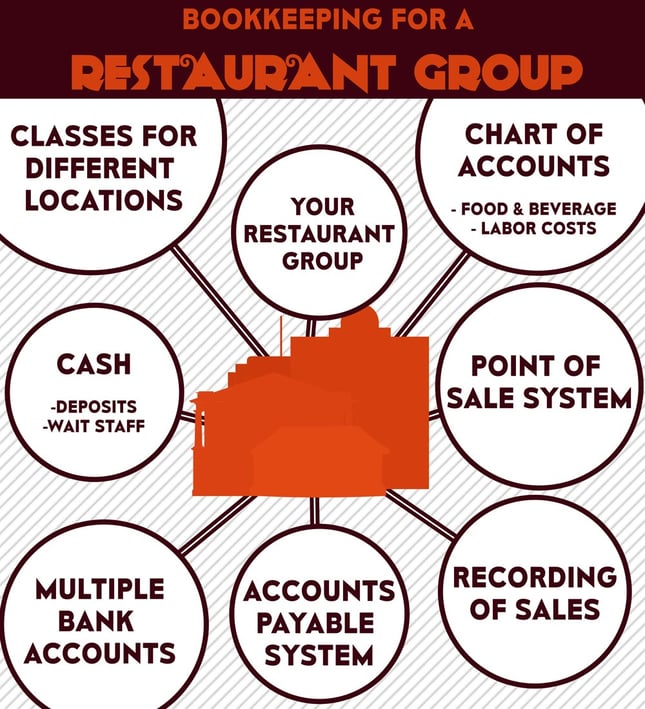

Bookkeeping for a restaurant group that has different locations and different restaurants under it can be tricky. There are tight margins to maintain.

In addition, spoilage, theft, and inventory must be controlled to maintain profitability. In order to do this, the books must work like a well-oiled machine.

There can't be any flukes or the whole machine is compromised and margins decrease. Follow this guide to monitor profits and grow your restaurant locations.

|

Here are guidelines you can follow to ensure that every restaurant in a restaurant group is controlled to improve its chances of success. |

Keep Your Chart of Accounts Simple

The chart of accounts is very important to restaurant accounting, especially when working with multiple locations.

This will generate categories for expenses and income and determine how reports look.

It's important to avoid over-complicating the chart of accounts.

If it's complicated, generally, the reports will not be understandable, and an owner may have difficulty figuring out what all the numbers mean. Here are our recommendations for a restaurant:

Food and beverage - separate income and cost of goods sold into food, alcoholic beverages, and non-alcoholic beverages. This means that food and beverage ratios can be computed a little bit easier.

Labor costs - this is one of a restaurant's highest expenses. Keeping close track can help cut labor costs and manage how it's affecting the bottom line.

Use Your POS System as a Tool

The restaurant POS system you choose for your restaurant should not be taken lightly. Proper set-up takes a long time, but it is completely worth it.

Knowing the system's ins and outs means the reports outline key metrics the business has deemed important. Having the right information is worth more than having a lot of information.

Many restaurants experience theft. A restaurant bookkeeping system that reports correctly can help keep track of daily deposits from the register to the bank. If the cash reports don't match, something is wrong.

The daily sales summary report can be an excellent report to check daily to ensure theft has not become a problem in a restaurant.

Here's a link to 4 amazing restaurant POS systems.

Depending on the size of your restaurant and your specific needs, there are some good options out there. I would recommend going with one of the major players in the POS market, as they come and go so quickly. You want to go with a reputable company.

I have seen restaurants use up to three POS systems before they finally found us and asked for advice.

Monitor Your Daily Sales Summary

The daily sales summary report tells you everything that happened in your restaurant on a given day.

As a multi-location restaurant, you should record each restaurant's daily sales in a separate journal entry. You can create and record a daily sales journal entry for each location.

This includes sales, payments, and comps. More importantly, it reflects how you are being paid. Payments come in the usual cash, check, credit card, and comps, but now there are also delivery service payments.

You need to create a separate sales journal entry for each location and each day to mirror your bank activity. Since your merchant credit card processing occurs daily, you must mimic this in your accounting system.

Each journal entry should be set up as a QuickBooks memorized transaction, which will reduce data entry. If your software allows for an external plugin, it could automatically import your daily sales journal entry into QuickBooks.

Remember to assign classes to the income and expense items so that your financial reports reflect them appropriately.

The daily sales summary needs to be balanced daily, or reconciling the books and getting accurate information from QuickBooks will prove difficult or even unsuccessful.

Without the proper information from QuickBooks, your company may be losing money without knowing it.

Accounts Payable System

Managing the accounts payable system can be a daunting task for a restaurant, especially for owners of restaurants with multiple locations.

You want to centralize all the invoices at one location, either an office at one of the restaurants or a separate office. Then, all invoices need to be entered into QuickBooks and filed.

A filing cabinet still works, but we would prefer to move the filing to a digital system.

Once bills are entered, they need to be paid. I recommend printing checks directly from QuickBooks or using QuickBooks's online bill pay feature.

To make sure that bills are being entered correctly:

- Send all paperwork to one main location;

- Input all invoices into QuickBooks;

- Use a bill pay feature synced with QuickBooks to pay bills.

Pro Tip: As a precaution, you should never let a bookkeeper have the ability to sign checks and send a bill payment. This offers too much of an opportunity for theft. Instead, allow them to create the checks and print them, then have the owner sign off.

Create Multiple Bank Accounts

After seeing several restaurant groups come up with different bank account solutions, I have come up with a good recommendation.

If you own a restaurant with several locations, I would have the following bank accounts:

- operating checking

- payroll checking

- general savings account

Pro Tip: I do not recommend setting up separate checking accounts for each location. I would only recommend separate checking accounts if you have several different restaurant groups.

Here's our recommendation:

- Send all cash and credit card deposits to your operating account from various locations.

- Then, manually move money from the operating account to the payroll account as needed.

- Finally, a savings account for additional funds should be linked to the operating and payroll accounts as overdraft protection. If the savings account can't be used for overdraft protection, set up a credit card that can offer it.

Use Classes For Different Locations

Restaurant bookkeeping management must figure out how to account for the income and expenses of each restaurant location.

If you use QuickBooks Online as your accounting system, you should use the class tracking feature to separate the income and expenses for the various restaurant locations.

You can turn on class tracking in QuickBooks easily.

- Click on the Gear icon in the top right of the screen

- Select Accounts and Settings

- Click on Advanced

- Edit the Categories section and toggle the Track Classes to on

- I recommend checking the box to notify you if a class isn't chosen. That helps prevent going back and figuring out where it came from.

- Also, in the drop-down under Assign Classes, I recommend selecting "One to each row in a transaction." If a bill should be split between locations, you can assign amounts to different classes.

- Save

If you properly use class tracking, you can now report on the profitability of each restaurant location. You can run a profit and loss by class, showing each location's profit and loss and a summary of all locations.

This will help you track the profitability of each restaurant as well as the restaurant group as a whole.

You should use this profit and loss report to identify possible issues and opportunities. If you see an unclassified column, you did not assign a class to those particular items.

Dealing With Cash

Dealing with cash in a restaurant can be a concern. I will break down my advice into two areas;

- Wait staff checkouts/cash drawer

- Nightly cash deposit

Wait Staff Checkouts/Cash Drawer

I recommend keeping your cash drawer at a predetermined amount that nobody knows except the owner and manager.

A manager should check and sign off on each wait staff member's checkout and handle all cash, both in and out of the cash drawer.

Make Nightly Cash Deposits

My recommendation is that the manager or owner handles the nightly cash deposit. I would then have your bookkeeper check the nightly bank deposit vs the POS daily sales report to look for discrepancies.

Cash can then be deposited into the bank for several days of sales as long as that information is documented.

|

For example: You might deposit the cash for 5/1-5/6 all at once. You can easily track and verify actual cash deposits by using the QuickBooks undeposited funds account or a cash clearing account in your daily sales journal entry for cash payments. |

Outsource Your Bookkeeping

Bookkeeping for a multi-location restaurant can be a difficult task.

You need to be an experienced restaurant bookkeeper to implement a restaurant-specific bookkeeping system that will work. It is integral that you keep cash flow management in check.

A lot is happening, and you need an experienced restaurant bookkeeper to build and maintain the bookkeeping system.

The owners and various restaurant managers will also play a critical role in the bookkeeping system. However, correctly setting up your restaurant bookkeeping system will allow you to scale your restaurant concept.

Outsourcing your bookkeeping provides financial reporting, allowing you to assess the profitability of your restaurant locations and determine whether opening a new location is recommended.

Please consider our suggestions and hire a bookkeeper with restaurant experience. Look for a bookkeeper with cash management skills and a comprehensive understanding of multi-location restaurant bookkeeping.

With over a decade of experience in restaurant bookkeeping and management, we have developed a pretty solid bookkeeping system for multi-location restaurants.

Comments