Restaurant Bookkeeping 101 - [2025] 5-Step Simple Guide

Long hours, high overhead, wasted ingredients, and difficulty making profits are some of the barriers to restaurant owners' success.

One of the neglected aspects of restaurant management is bookkeeping. Once you're behind on your restaurant accounting, it is difficult to get caught up.

In this guide, we will identify the most important aspects of your restaurant's books and then remove the hassle of manual bookkeeping with the automation of your system.

You'll also understand the basics of what a trained accountant will help with as you develop a reporting and growth plan.

It's crucial that the books are up-to-date for a restaurant that already has a trained accountant or is just looking for tax deductions for restaurant owners.

Effective restaurant bookkeeping starts with you. Whether you run the accounting services yourself or outsource your restaurant accounting, staying on top of the day-to-day bookkeeping is essential to staying ahead of your competition and turning a profit.

How do you handle bookkeeping for a restaurant? 5 Easy Steps!

|

|

|

| 1. Record Daily Sales | 2. Set Up Accounts Payable | 3. Outsource your payroll |

|

|

|

| 4. Reconcile all accounts | 5. Analyze financial reports |

1. Record Sales Through Your POS Daily

One of the first things you must figure out is how to record your sales properly. Many find QuickBooks for restaurants to be an effective recording system.

Record Your Sales Entries Per Day

Record a separate daily sales entry for each day (not monthly or weekly). This method mimics how cash and credit card deposits hit the restaurant's bank.

Most restaurants accept credit cards and should settle the batch daily. This will result in a credit card deposit or deposits hitting your bank account separately for each batch.

You need to analyze how funds hit your bank and set up your restaurant bookkeeping system to mirror that activity.

Generate a Sales Report

To record daily sales, you need to generate a report summarizing your sales.

Most restaurant POS systems include a daily sales summary. If you require more detailed information, you will need to customize the report with your POS system.

Create a Daily Sales Journal

Once you have a sales summary, you should set up a daily sales journal entry and create a memorized transaction in QuickBooks.

Automate Your Restaurant POS with QuickBooks Online

Instead of entering all this information manually, you can automate the process.If you aim to automate all the steps mentioned above to create a daily sales journal in QBO, we highly recommend Shogo.

We have used Shogo for years to automatically generate the daily sales journal from various restaurant POS systems into QBO.With Shogo, if there are any errors, it will hold back the journal entry until you update the accounting mapping.

For instance, if you start selling a new item and create it in your POS, Shogo will automatically detect this and email you to update your accounting mapping with the proper QBO category.

Once you make this update, it automatically sends the journal entry to QBO. Another feature we appreciate about Shogo is the ability to quickly and easily reconcile merchant service deposits.

The Shogo journal entry enables you to reconcile your merchant service deposits, ensuring you receive all the money you are due.

Shogo's website lists the POS systems it integrates with, and they are continually adding new integrations.If your POS system isn't listed, contact support to check if they plan to add it soon.

Connecting Shogo to Your POS System

Connecting Shogo to your POS is fairly quick. They've done a fantastic job of making this seamless integration easy.

Shogo doesn't let you do much until you enter your POS information and are connected to that.

So, you'll see a screen with all sorts of different POS systems.

While many great restaurant POS systems are on the market, we like Toast the best.

Restaurant bookkeeping with Toast and QBO is by far our most preferred setup. Our clients love Toast's front end, and the reporting and accounting integration back end is really great for accountants.

So, for this example, we'll utilize Toast, although the setup process will more than likely be similar or the exact same for the rest of the systems.

You'll have to fill out a form with all your restaurant's information, including the name, location, and even a store code if you have multiple locations with the same name, like with a franchise.

After you've entered the information and saved it, Shogo will ask you to enter information into your Toast account.

Visit the Toast integration page to find your restaurant ID. Shogo will have a link to the integration page to make it easier.

Enter the Location and Group IDs, and click Add New.

At that point, you should be able to see all the restaurant locations and pick the one you're attempting to connect to.

Hit confirm, and you'll connect.

Connecting Shogo to QuickBooks Online

Now that Shogo is connected to your POS, it's time to plug it into QuickBooks Online or your preferred accounting system.

QBO has worked very well for all of our restaurant clients, so we recommend it 100% of the time.

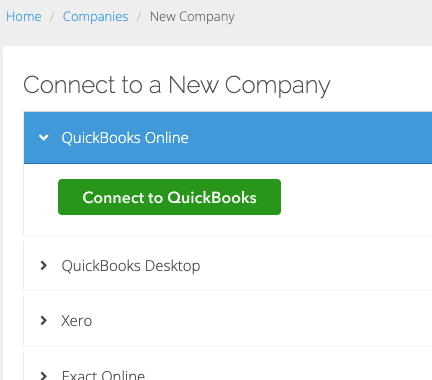

To connect to QBO, go into Shogo and click Settings -> Accounting. You'll want to connect with a new company. Select "Connect to QuickBooks"

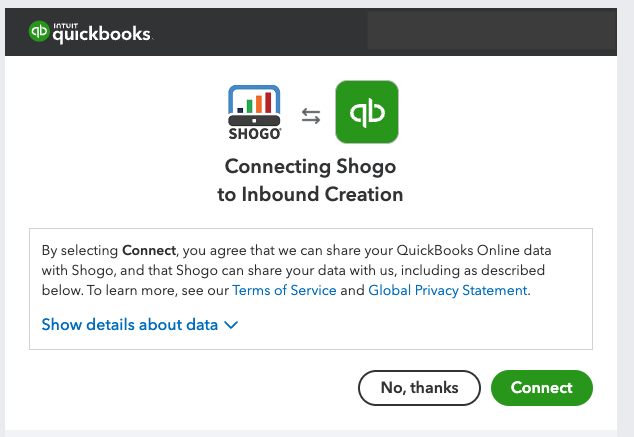

Shogo will ask for permission to connect to your QuickBooks account. Hit Connect.

One of the reasons we love connecting to QBO and to any restaurant POS system from Shogo is the steps and amount of time it takes.

You should see the information for your QBO account and can change any information through settings.

2. Handling Accounts Payable

The next step of an effective restaurant bookkeeping process should be to set up accounts payable correctly. Keeping your vendors happy is important if you want them to continue doing business with you.

- To start, learn how to enter bills and pay bills in QuickBooks; both are easy tasks to accomplish.

- Enter your bills 1-2 times per week and pay them once per week.

- If you are cutting checks for your bills you want to make sure to print checks from QuickBooks. This will automatically feed the payment information into your QuickBooks file, thus reducing unnecessary data entry.

- Another option is to pay your bills with online bill payment by linking your bank account to QuickBooks and signing up for online bill pay.

Pro Tip: Another part of your accounts payable will be setting up a credit card in QuickBooks. I have seen many users set up credit cards incorrectly in QuickBooks. A credit card should not be set up as an expense-type account; it should be set up as a credit card type. Your expenses are recognized as you enter credit card charges. Setting up a credit card with the correct type will also allow you to reconcile the account, which is very important.

Using Bill.com for Restaurant Accounts Payable

If you are looking for a cloud-based accounts payable system we would highly recommend Bill.com. Bill.com allows you to add various users with different permissions.

You can then upload your invoices to Bill.com to allow your accountant to code them properly.

You would then have a payment approver approve any bills they want to be paid at any time. This allows you to manage your accounts payable completely in the cloud and the ability to pay your bills from anywhere.

Bill.com integrates with QuickBooks online. It will require an additional reconciliation (if you have a good bookkeeper) of the Bill.com clearing account.

Restaurant Accounts Payable Services

A few notable restaurant accounts payable services that are worth mentioning are XtraChef by Toast, MarginEdge, and PlateIQ.

You can upload your invoices to these services, and they will code them by item to your various COGS and expense accounts.

Additionally, they allow you to approve invoices that you want to be paid.

These services allow you to automate your accounts payable and get a more accurate COGS figure.

XtraChef is a Toast product and integrates directly with Toast. MarginEdge integrates with several POS systems.

Both XtraChef and MarginEdge allow you deeper COGS and financial insights and controls directly in your POS system.

3. Payroll

As a business owner, you are at major risk by doing your own payroll.

If you incorrectly file your payroll taxes or file them late, the penalties and interest you will be assessed can be quite large. You are held at a high level of liability if you do not outsource your payroll to an accounting firm.

Outsourcing your payroll is surprisingly affordable and a necessary option to ensure consistent and reliable paychecks and accounting.

Every small business should outsource its payroll.

Pro Tip: Look for a payroll company that is very reputable. Require the payroll data to have the capability to be imported into QuickBooks and all reports and paychecks to be sent digitally. Not only does this save time, but it will also reduce payroll liabilities.

We use ADP's payroll service and recommend it to most of our clients. Our employees can electronically view their pay stubs, all their tax deductions, and even what they're saving on retirement.

They can also manage how much of their funds are deposited into their IRA or bank accounts.

Gusto Payroll For Restaurants

I would take a hard look at Gusto Payroll services as an alternative to ADP. Gusto has come a long way since its start. At first, it wasn't that robust.

However, I would say that Gusto is as good, if not better than ADP. The pricing is much simpler, cheaper, and easier to understand than ADP's. They charge a flat monthly fee and a per-employee fee. However, you can run as many payrolls as you want per month.

There is also an online employee portal and they have great HR support.

From an accounting perspective, I think Gusto has one of the best general ledger QuickBooks imports of all the payroll providers. It is much easier to understand and use than ADP's.

Toast Payroll Services

Another service worth mentioning is Toast Payroll. If you are already using Toast for your POS system, it makes sense to consider their payroll service since your payroll data can easily be pulled from Toast. Obviously, there are fewer issues when two sister systems integrate together.

This will make the reporting of payroll much more efficient.

The only automated integration we know of for Toast payroll to QuickBooks is through xtraCHEF.

This option can save time by automatically syncing and coding your payroll journal entries, but you will need to upgrade to a premium subscription for this service.

4. Reconciliation

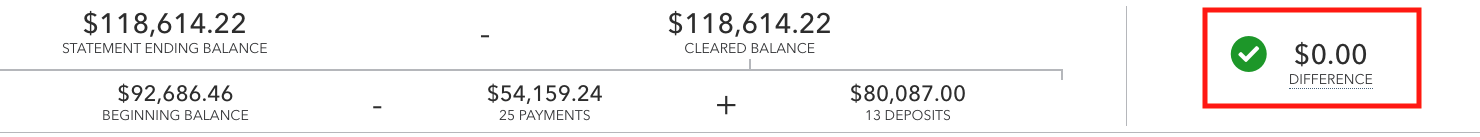

Reconciling QuickBooks accounts is the single most important piece of the entire bookkeeping process.

Reconciling your accounts is the only way to know that you have recorded all of your financial transactions. You need to reconcile all of your accounts, not just your bank accounts.

You should reconcile bank accounts, credit cards, loans, lines of credit, clearing accounts, and payroll liabilities.

Any account that gets a statement with a beginning and ending balance can be reconciled. Account reconciliation ensures that you are looking at accurate financial reports.

And honestly, all accounts on the balance sheet should be verified at least once a year.

How to Reconcile Your Accounts

If you are ready to reconcile an account in QuickBooks Online, follow these steps:

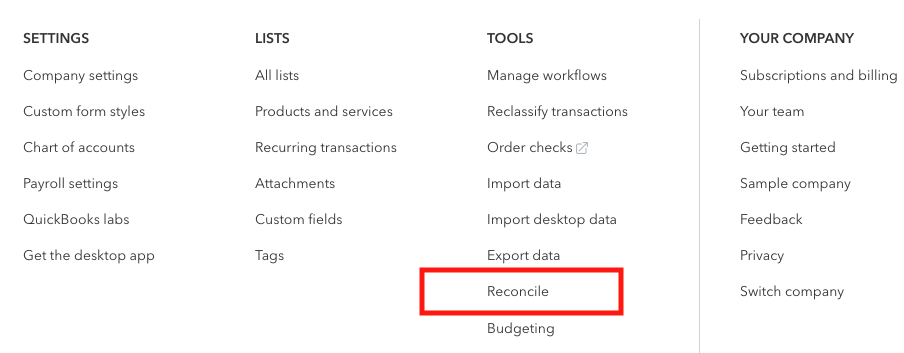

Click on the Cog icon in the upper right corner of QuickBooks Online. Then, under Tools, select Reconcile.

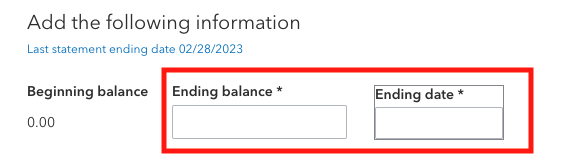

On the next screen, simply add the ending balance and ending statement date from the statement you are reconciling.

On the next screen, simply mark off your deposits and payments that cleared your bank on the statement until you show a difference of $0.

That's it.

You can attach your statement to the reconciliation in QBO to make it easy to reference.

Now, make sure to reconcile all bank accounts, merchant clearing accounts, credit cards, loans, lines of credit, and payroll liabilities every single month.

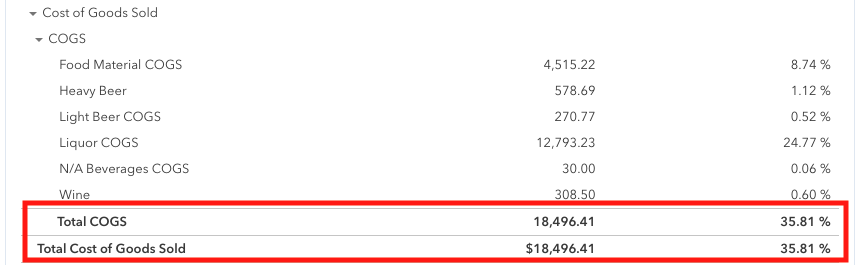

5. Financial Reporting

If you are not using financial reporting for your restaurant, then you are running your business blind. With such tight profit margins in the restaurant industry, it is important to analyze your financial reports on a regular basis.

Restaurants should be looking at sales vs. cost of goods sold ratios as well as labor ratios.

Another ratio many restaurants should consider is the prime cost, which aims to keep the cost of food + beverage + labor at roughly 60% to 65% of your total sales.

Prime Cost Calculation in QuickBooks

The key to quickly calculating your prime cost in QuickBooks is having your chart of accounts set up properly.

You need a parent account for both Costs of Goods sold and Payroll costs. Then, you want subaccounts under each of those with the level of detail you desire.

When your chart of accounts is set up in this manner all you have to do is modify your profit and loss with the correct settings.

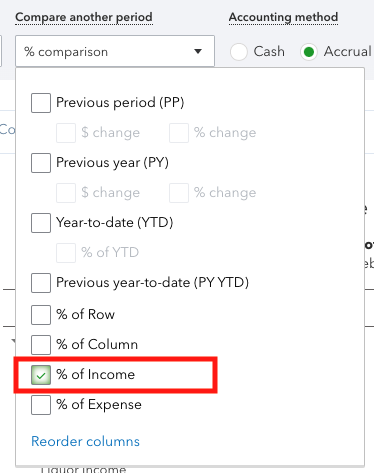

First, run a profit and loss by going to reports on the left-hand side and selecting reports.

Now you can type in profit and loss or find it under the business overview section.

Run the profit and loss for whatever date range you wish to look at.

From the "compare another period" dropdown, put a checkmark next to % of Income.

Now you can easily see your COGS percent of income.

And you can also see your total payroll cost percent of income.

You can add those percentages together to get your prime cost. I have even seen some restaurants make Payroll a subaccount of COGS. Just make sure you keep a Payroll parent with the subaccount breakdown.

You might also want to check with your CPA to make sure they are ok with this change.

Calculating Costs

Cost of Goods Sold

“Cost of goods sold” refers to the products you buy that make up your product. And in the restaurant business, it’s no secret that, in order to make food, you’ll have to buy ingredients.

If you’re opening a franchise restaurant business, such as Pizza Hut or TGI Fridays, you’ll source your food directly from suppliers as instructed by the home office.

But if you’re striking out on your own, you’ll be responsible for buying ingredients, possibly every day.

According to Toast.com, restaurants typically try to keep the cost of food to about 33 percent of their total sales.

Beverages are another expense, but the good news is that liquor is a great way to boost your profit margin.

Chances are you’ve noticed this already if you’ve ordered a bottle of wine. The same bottle that costs $15 in your local liquor store could cost $30 or $45 when you’re out.

Cost of Labor

Labor expenses depend on your restaurant. Will your wait staff work for tips, or will you add gratuities to every bill? Will you furnish uniforms or provide an allowance?

Waiters and waitresses who work for tips typically earn smaller hourly wages than those who don’t, but you’ll also need to pay for kitchen staff, hosts, valets, cleaners, and other essential personnel.

Regardless of your choices, you’ll still need to pay unemployment taxes. And if you hire full-time wait staff, you may also need to furnish benefits.

Many restaurants rely on part-time or seasonal employees to avoid this expense. Once you can anticipate your busy times, you can schedule your staff members accordingly.

Cost of Occupancy and Equipment

Unless you’re lucky enough to own space and equipment outright, you’ll need to pay for your infrastructure. That could be rent, a mortgage, or property taxes.

Utilities, cooking and cooling equipment, insurance, and signage are common expenses, but you’ll also need to consider maintenance costs.

Remember, servicing your commercial ovens and refrigerators will probably cost more than what you pay for your Frigidaire at home.

Cost of Marketing and Administration

Lastly, you’ll want to advertise that you’re open for business. This may include newspaper ads, billboards, and social media.

Social media, at least, is free — and you’ll have direct access to the customer marketplace you want to serve. Offer promotions and coupons to get customers in the door.

There are many free solutions that work really well. We have actually used Adobe Spark (now Adobe Express) to create social media graphics in the past.

Of course, you’ll want to pay yourself and any contractors you need to help with necessities such as bookkeeping.

You’ll be plenty busy managing day-to-day operations, so consider outsourcing payroll, payables, and other functions to a firm that can let you focus on making your business a success.

Looking at profit and loss comparisons to previous periods and years will also give you some insight as to how things are going financially.

Restaurant financial reporting can be the difference between success and failure.

Should I Outsource My Restaurant Bookkeeping?

As they say in the business industry, leverage your strengths and outsource your weaknesses.

Or, in the case of learning how to grow your restaurant, outsourcing leverages the actual cost of having an outsourced bookkeeper versus an owner doing it themself.

Learning to delegate tasks is a necessary step in becoming an effective manager.

As a business owner, it can be tempting to take on all of the roles; however, outsourcing your restaurant accounting services will relieve your pressure and liability and allow you to focus on your restaurant's growth and management. Are you ready? Get started by scheduling a financial consultation for your business.

There are many other aspects to restaurant bookkeeping, like restaurant POS selection, inventory controls, controlling theft, and handling cash. However, the 5 simple steps above will establish the foundation for a solid bookkeeping system. As you grow, you will have to continually modify your bookkeeping system to meet your needs.

Comments