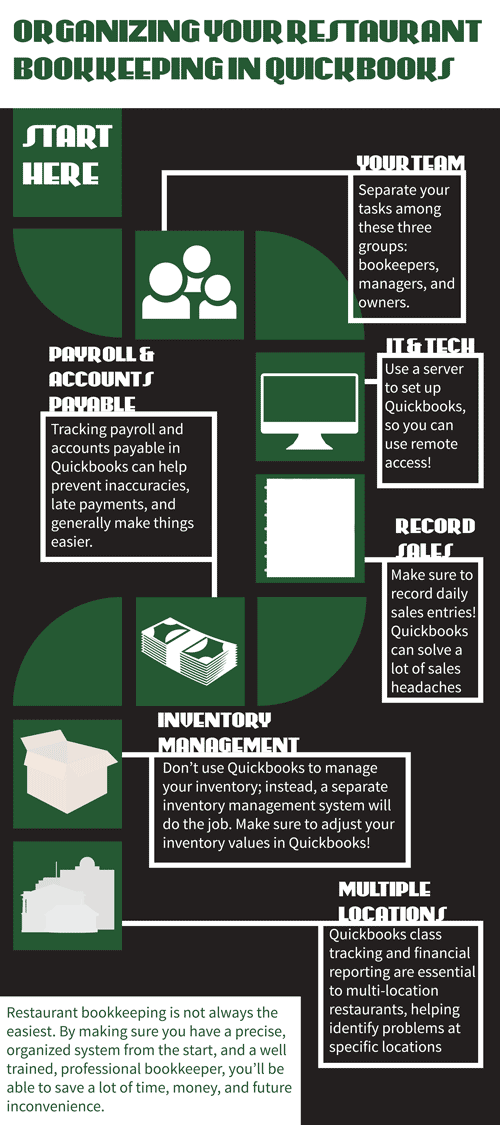

How QuickBooks Improves Your Restaurant Bookkeeping

QuickBooks is a popular choice for restaurant bookkeeping.

Intuit has no version specific to the restaurant industry, so QuickBooks must be customized to meet your needs.

However, at the beginning of the QuickBooks setup process, you can select a restaurant as the type of company you're setting up.

Let's list the other modifications that should be made to QuickBooks to ensure your restaurant is set up correctly.

Task Delegation

First, who is involved in the decisions, and who should have access with what abilities?

Restaurant Owners: Owners should be the only people with the ability to sign checks, pay bills, or move money across different accounts.

There are a couple of reasons for this, but the most important one is that allowing the bookkeeper access to cash is an opportunity for theft. Owners should also approve payroll.

Bookkeeping Team: Bookkeepers should enter transactions, bills, daily sales, and deposits and verify deposits. They should also regularly reconcile the accounts. They should not handle cash.

Restaurant Managers: Restaurant managers should handle cash deposits. The bookkeeper will verify the cash deposits versus sales records while doing their tasks.

The managers should also be focused on regulating the inventory of food and beverages. Lastly, they should verify hours and submit payroll to the owners for review and approval.

QuickBooks Install

The program should be set up on a server that allows multiple employees to access QuickBooks simultaneously without interfering with one another.

This is especially helpful for restaurants with multiple locations, as there can be a central location where bills, invoices, and paperwork are stored and shared.

Daily Sales Journal Entries

As the name says, daily sales must be recorded daily—the simple answer as to why is this: the verification of bank deposits.

Even if credit card transactions are pulled every couple of days, the actual sales of the day need to be recorded.

This is a record that the amount deposited into the bank daily matches the amount sold on that day. If there are gaps in the amount sold compared to the amount deposited, there's a problem.

Payroll & Accounts Payable

Typically, managers focus their time on helping the business. They don't necessarily make time to enter bills into the accounting system.

This may result in late payments, inaccuracies, penalties, and fees. It can also create a poor relationship with vendors, which could result in increased rates and lower priority in their deliveries.

To avoid this issue, appoint a bookkeeper or an administrative assistant to enter these bills in a centralized location.

There should be a process for determining the bills that need to be entered and those that have already been entered.

The owners should still be the only ones signing the checks when paying the bills and the ones to approve payroll hours and pay.

Restaurant Payroll

ADP, Gusto, and Paychex all do a good job processing company payroll.

They stay up to date on changing tax laws pertaining to your employees, and non-compliance can get you into a lot of trouble and get you fined.

This is one reason why every business should outsource its payroll.

You need two basic things in your outsourced option: (1) Does it integrate with QuickBooks? and (2) How well do they stack up against competitors?

The industry is very competitive, so you can assume that almost everyone will charge similarly.

Finding a low-priced competitor may even be a red flag, indicating that you should question their credibility and the work they do.

Restaurant Inventory Management

QuickBooks does not have a good system for keeping restaurant inventory. In the restaurant business, inventory has to be adjusted often, and it would take a brilliant bookkeeper to do a good job.

Instead, you may want to use inventory management software from another source or even create an inventory system yourself.

Then, you can go into QuickBooks and adjust the values manually once a month.

Multi-Location Restaurants

With multiple locations, you need to use QuickBooks' class tracking to differentiate between the income and expenses for each location.

A bookkeeper who understands class tracking and financial reporting is also essential. Having a payroll provider that supports multiple locations is essential for reporting so that you can see what payroll expenses are coming from which locations.

Restaurants are one of the more complex types of books to keep. Ensuring that QuickBooks is set up correctly from the beginning helps to save time, money, and headaches.

The proper procedures will have an impact on appropriate reporting for both management and your CPA. If nothing else, consult a bookkeeper on how to properly set up a bookkeeping system and what tools will work best for you and your business.

Comments